In this report, we share our most valuable insights from the second quarter of 2021, as well as our predictions for the next quarter

The digital deal

The digital trend that we reported on in Q1 has continued to grow in the shadow of the pandemic.

In the Nordics, where there was already a high adoption rate of data rooms, our customers are embracing new tools that helps digitize and streamline the due diligence process.

An example is the Task Manager, which we launched in May that enables data room facilitates assigning and monitoring the document upload and review processes within the data room.

We also see that the willingness to pay for a premium data room solution is increasing in markets that have traditionally had a lower adoption rate. A good example is the Netherlands, where raised awareness and a desire to mitigate risk has increased the adoption rate of Admincontrol’s data room solution, in favour of generic tools like low-cost file sharing solutions.

As dealmakers are embracing digital solutions throughout the whole deal process, we see a growth in demand for digital offerings covering the complete deal life cycle.

For example, our global strategic partnership with the Dutch dealmaking platform Dealsuite, giving Dealsuites customers access to a webshop with a tailored offering, has been well received in both the Netherlands, the UK and in other markets where Dealsuite is present.

Continuing high deal volumes

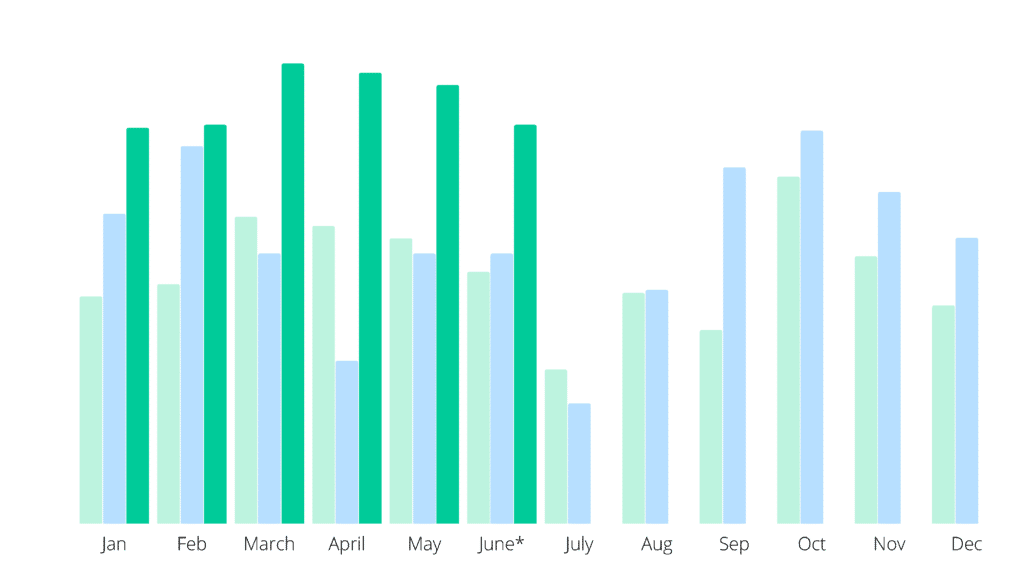

In Q4 2020 deal volumes started going up again after the dip caused by the pandemic. We saw a further acceleration by the end of Q1 this year, to a record high level that has remained throughout the second quarter. We saw an increase of 83 % in new portals on our platform in Q2. The increase for 1H 2021 compared to 1H 2020 is 53 %, reflecting the general trend of high deal volumes.

When we compare the number of portals activated in Q2 2021 with last year’s level, it is important to note that Q2 2020 was the period where the pandemic hit the hardest, before the markets started to recover during the second half of the year.

This immense growth can be contributed to the general growth that Admincontrol is seeing as a company, especially in new markets like the UK and the Netherlands, but undoubtedly also due to the record high dealmaking activity in the market.

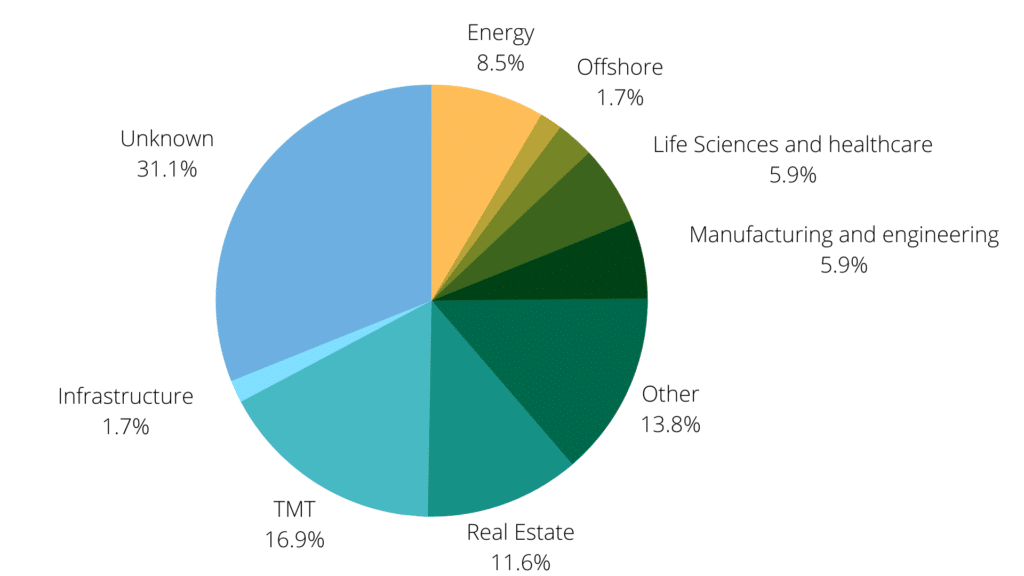

The illustration below shows the industry break-down of new portals opened during Q2 2021. The chart includes data where the industry can be derived, which includes about two thirds of the data set.

In Q1 we reported on high levels of deals within tech, life sciences and energy.

Whereas energy has cooled down slightly, tech is hotter than ever, and we see that those tech deals are driving the high activity.

We are spotting four main trends that we would like to emphasize for Q2:

-

The tech transformation

With the digitalization trend that was accelerated by the pandemic, we see that the digital transformation has a broad if not universal reach.

The fact that a growing proportion of the deals on Admincontrol’s platform are tech deals is a reflection on the increased number of technology companies and the need for traditional non-tech companies to digitalize.

In essence, companies that have not been in tech traditionally are transforming into tech companies or adopting tech competence, and many of these companies are doing so through acquisitions.

-

Life sciences

We still see an increasing number of life science deals on our platform. These can sometimes be a hard to differentiate from tech deals, as there is often a tech component. We see a rise of digital tools from everything to patient journals to monitoring of diseases.

-

Real estate boom

There have been high levels of real estate deals since Q4 2021, which has reached a new high during the quarter. We see that as many as 17 % of the deals with an identifiable segment is within real estate. One reason could be the high prices due to record low interest rates.

-

The IPO trend continues

As reported in Q1, we have seen a record number of companies preparing for an IPO. This trend has remained throughout Q2 and we expect that the IPO rush will continue throughout 2021.

Expectations for the next quarter

We expect that many dealmakers will take a well-deserved summer holiday after a very busy period, giving the markets a slow down during the holiday season.

That being said, we still have an unusually high number of deals being prepared on our platform, indicating that the activity levels that we have seen throughout the first half of the year are likely to return in fall.

In the meantime, we wish everyone a Happy Summer!