The digital trend that we reported on in Q2 has continued to grow.

With statistics of aggregate data from our solution, we can extract valuable insights. In this report, we share our most important findings from Q3 2021, as well as our predictions for the next and final quarter of the year.

Back to deal-making

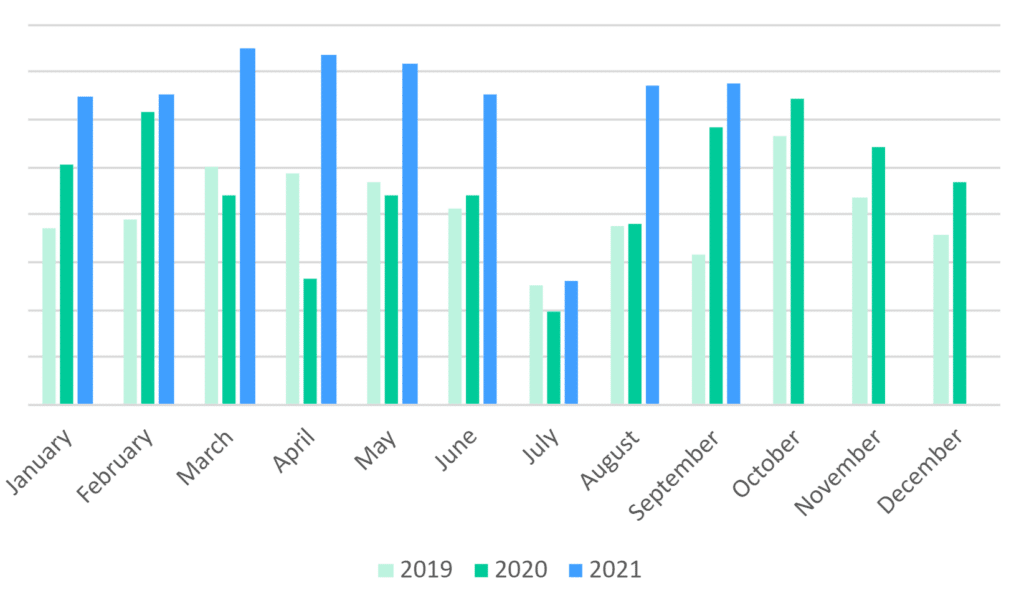

It is almost one year since the deal markets started soaring again after the dip caused by the pandemic. Except for a quiet summer period, as usual, we see no signs of a slowdown yet. We saw an increase of 40 % in new portals on our platform in Q2 compared to 2020 numbers. The increase year to date compared to 2020 is 50 %.

This growth can be contributed to the general growth that Admincontrol is seeing as a company, especially in new markets like the UK and the Netherlands, but undoubtedly also due to the record high dealmaking activity in the market.

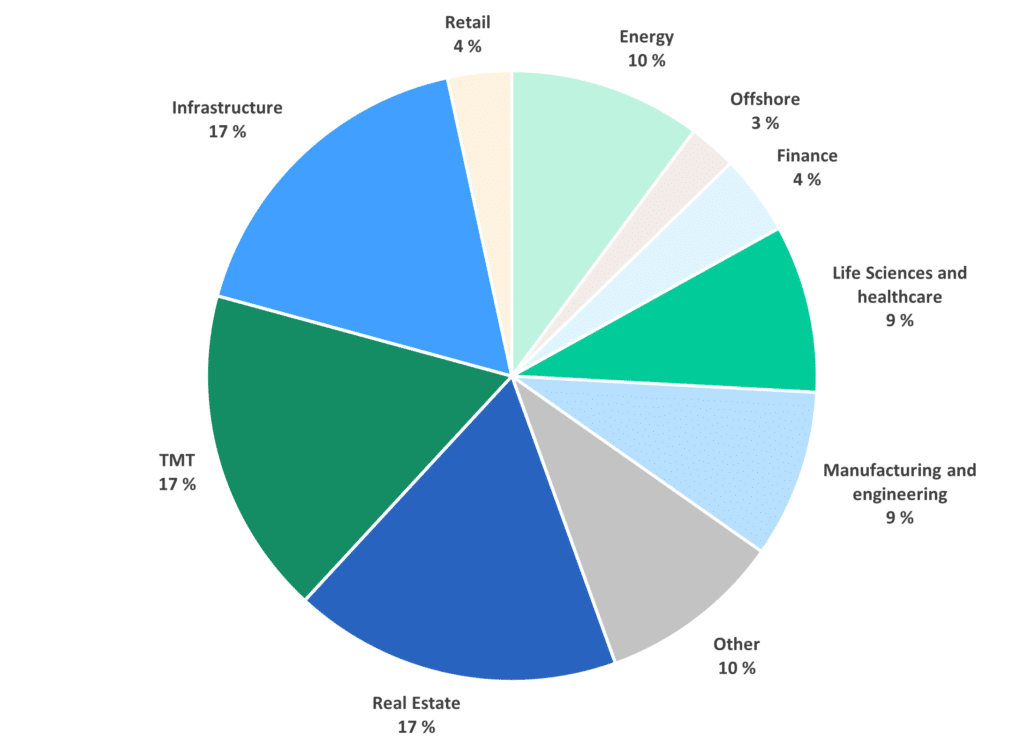

The illustration below shows the industry break-down of new portals opened during Q3 2021. The chart includes data where the industry can be derived, which includes about two-thirds of the data set.

New trends on the rise?

In our Q1 and Q2 reviews, we reported on high levels of deals in technology, life sciences, energy, and real estate.

These sectors are all still experiencing high activity levels. However, looking a little deeper at the numbers, we see a few interesting new trends and sub trends:

Educational tech

The tech transformation during the period has in many ways led to a learning transformation. We have seen a growth of existing tools such as the Norwegian Kahoot, and have seen many new tools and platforms appear.

Sharing economy

Another tech subcategory that appears to be on the rise are platforms enabling the sharing economy. It seems like consumers – especially younger generations – are really embracing these types of platforms, making room for new players in the market.

Travel and tourism on the rise

After a period with little activities in this segment, we are seeing a rise of deals and dealmaking activities within travel and tourism.

Sustainability focus

Looking more into the details, many of the transactions, both within energy and tech, but also within other categories, seem to have a clear sustainability component to them. Moreover, we see that it has become more common to run ESG reviews on portfolio companies. It seems as if a decision-maker sees a clear value in sustainability – not only as a way to mitigate risk, but also as a business model.

Expectations for the next quarter

With the activity levels building up during the past years, it seems like we are not nearing a slowdown yet. With more than 700 live processes on our platform and more than 100 portals being prepared for due diligence now we expect this fourth, and traditionally busiest quarter, of 2021 to continue with soaring deal levels.

We expect that the trend that we have seen with a high level of IPOs will continue throughout the autumn.

When it comes to M&A, we do not foresee any major changes, and expect that we will keep seeing a high level of tech deals, and high activity within life sciences, energy, and real estate.